The shocking truth about why big companies are doomed

And how you can build a billion-dollar empire with a tiny team!

By David Schenk, CEO of Schenk Financial Research

We all know the dilemma: Companies grow, structures become rigid, and suddenly it feels like a bureaucratic machine that no one can truly control. Joel Shulman and Thomas T. Stallkamp's book Getting Bigger by Growing Smaller shines a new light on this old problem. And it offers a solution that’s as simple as it is revolutionary: Get bigger by staying smaller.

The Problem: Corporate Overload

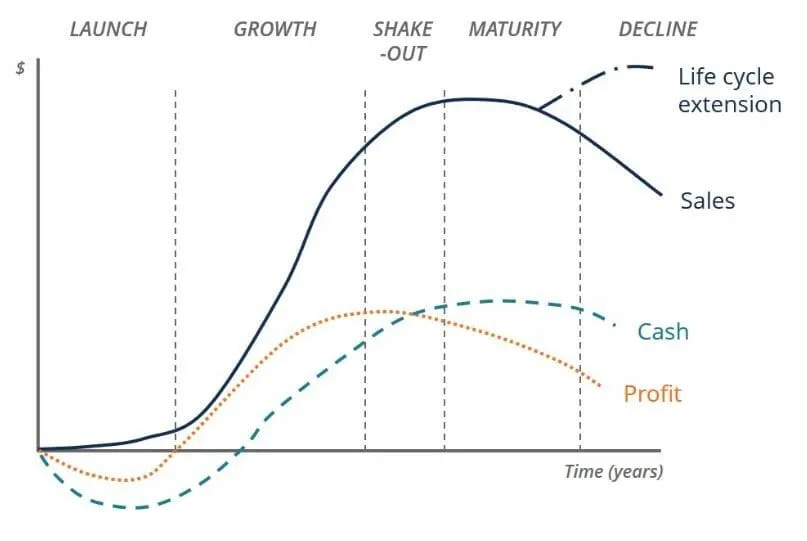

In their analysis, Shulman and Stallkamp describe how large, established companies often end up trapped in a growth phase that’s anything but dynamic. With success comes bureaucracy, and with bureaucracy, inertia. Big organizations rarely manage to maintain the agility that once made them successful – the entrepreneurial spirit that helped them grow disappears. The authors call this the “Corporate Lifecycle,” a kind of aging curve that many companies inevitably follow: youth, growth, maturity, and then decline.

But instead of resigning to this fate, Shulman and Stallkamp propose a strategy that throws conventional thinking out the window: creating Strategic Entrepreneurial Units (SEUs).

At Schenk Financial, we deliver bespoke advisory services tailored to high-net-worth individuals seeking optimized portfolio performance.

📧 Connect with Us Today:

premium-advice@schenkfinancial.com

💼 Eligibility Criteria:

Our services are exclusively available to individuals with a net worth exceeding $50,000.

Empower your financial future with strategic insight and unparalleled expertise

The Power of Small Units

At their core, SEUs are small, autonomous teams that operate within a large company as if they were startups. They’re nimble, decisive, and largely insulated from the bureaucracy. The idea is as simple as it is brilliant: By breaking a large company into smaller, dynamic units, it can retain its innovative edge. The big ship moves outward, but the engines are agile like a speedboat.

The Logic Behind the Small Team

When I read this, I couldn’t help but draw parallels – not only to the companies ERShares invests in, but also to ERShares itself. Shulman and his team practice what they preach: they’ve built an investment firm that intentionally stays small.

A small, focused team doesn’t mean less power, it means more. Decisions can be made faster. Responsibility isn’t diluted through endless layers of hierarchy. And most importantly, the entrepreneurial spirit stays intact.

This model is also a key reason why ERShares has been so successful in its investments: they’re looking for companies that have this DNA. The firms that thrive in the long term often share the same approach. They’ve either stayed small or embraced SEUs to preserve their flexibility.

The Courage to Shrink

In times where we’re constantly told that growth is the ultimate goal, this mindset may seem counterintuitive. But maybe that’s exactly the point: Sometimes, it takes more courage to shrink in order to grow.

When I look around – at large companies and small teams – I wonder how often we unconsciously do the opposite: we add instead of simplify. We expand instead of focusing on what matters most. Perhaps it’s time to think like Shulman and Stallkamp: not “more,” but “better.”

At the end of the day, the question isn’t how big your team or your company is, but how flexible it remains. That’s the real art of growth – and one many of us need to learn anew.

Click here to invest in Entrepreneurial Stocks globally: